The Wallace & Turner 2022 holiday party kicked off at Springfield Country Club testing our golf skills on the simulator with pro Jake Houston. Then we headed to Fratelli’s for a delicious lunch.

Inland Marine Insurance: What It Does and Doesn't Cover

Don’t be confused - inland marine insurance coverage has nothing to do with the ocean or other waterways. If you have a business that regularly transports materials over land or stores materials in a location away from your ordinary business premises, you likely need inland marine insurance as part of your overall business insurance package. We explain more about this type of coverage below.

What is inland marine insurance and how does it work?

Commercial inland marine insurance protects your property from hazards while it is in transit via land or sea. This policy covers property regardless of its location, providing it is within the policy territory. Commercial inland marine policies can be written on a scheduled basis, a blanket basis or combination of the two.

Businesses can either get a standalone policy or get inland marine as an endorsement on another policy, although some types of inland marine, such as ocean cargo coverage, typically require a separate policy and sometimes from a specialty carrier, for example Lloyd's of London.

What does inland marine not cover?

Some exclusions business owners might not think about, include:

Mailing or shipping through a common carrier (e.g. FedEx, UPS) may or may not be insured through the cargo carrier.

If equipment is leased or rented from supplier, the renter business might need its own coverage on the equipment.

If property is damaged while it's being repaired, whether working on your own property or working on someone else's property.

Why would a small business need inland marine insurance? Who are good candidates?

Businesses that have property off premises or companies that ship their goods. For example, contractors (regular user of inland marine for tools used away from their shop). Industries that should consider inland marine coverage include: agricultural and farming, contractors, distributors, manufacturers, retailers, trucking operations.

How much inland marine insurance coverage do I need?

For endorsement costs, using a contractor's equipment as an example, $1 per $100 value for large equipment (e.g. bulldozer), and up to $3 per $100 value for small tools/equipment (drills, etc. that are more likely to be stolen).

A standalone policy could have a minimum premium, typically between $250 - $500. If attached to a business package, it might not be subject to a minimum charge. So, it's more advantageous from a premium standpoint to endorse or attach to an overall business package versus a standalone.

Learn more about Inland Marine Insurance here.

Questions about Inland Marine Insurance for your Ohio business? Contact us to speak with a commercial insurance agent.

P.J. Miller Discusses the Impact of Texting and Driving on Insurance Rates with Forbes Advisor

P.J. Miller - Vice President

Texting and driving is one of the most dangers behaviors drivers can engage in behind the wheel. And not only can it result in the worst case scenario of bodily injury or death, it can impact your insurance rates. Vice President P.J. Miller discussed the risks of texting and driving with Forbes Advisor.

“When texting, you easily lose track of speed and your surroundings, so aside from potentially getting a ticket, you are endangering pedestrians and/or road workers, which could lead to them being injured or killed by distracted driving. This can result in criminal charges, not just increased rates,” said P.J. “Additionally, you could lose your license or even your job.”

Read the full story here.

Questions about car insurance in Ohio? Contact us.

Finding the Most Affordable Health Insurance for Families and Individuals in Ohio – Colleen Corrigan Interviewed by MoneyGeek

Life & Health Agent Colleen Corrigan

For individuals and families looking for affordable and comprehensive health insurance in Ohio, they can turn to the state’s insurance exchange to review options. Wallace & Turner Life and Health agent Colleen Corrigan spoke with MoneyGeek to explain when Ohio residents can enroll for new coverage, how they can potentially save money and what alternatives there are to the Marketplace.

“The open enrollment period for individual and family health insurance runs from November 1 to January 15 in Ohio,” Colleen said. “Outside of open enrollment, a qualifying event is generally necessary to enroll in or make changes to your coverage.”

When asked about ways to take advantage of cost-sharing reductions and tax credits, Colleen commented: “Many individuals and families qualify for a subsidy to reduce the monthly premium for their Marketplace health insurance based on household demographics. The demographics which determine the subsidies available are:

Zip code.

Household size.

Number of family members on the health plan.

Gross household income projected for the year on the plan.”

Colleen added there are other short-term plans and individual plan options outside of the Marketplace, but its best to talk with your trusted insurance advisor to determine the right plan for your needs.

Read the full interview here.

Questions about health insurance coverage in Ohio? Contact our Life & Health department.

West Bend Mutual Insurance Awards $6,000 to Second Harvest Food Bank of Clark Champaign & Logan Counties Through Nomination by Wallace & Turner

Brian Erwin, Sr. Regional Sales Manager with West Bend; Tyra Jackson, Executive Director of Second Harvest Food Bank of Clark, Champaign and Logan Counties; Patrick Field, President of Wallace & Turner

Second Harvest Food Bank of Clark Champaign & Logan Counties received a grant of $6,000 from West Bend Mutual Insurance as part of the Spirit of the Silver Lining Award 2022. Each year, West Bend presents the award to several independent insurance agents and the nonprofit organizations they support. The award recognizes those agents and organizations for their dedication to delivering a silver lining to those in need.

The nonprofit recipients of the award receive a grant from the West Bend Independent Agents’ Fund. Since 2006, the Fund has awarded more than $1.4 million in grants which are used for sustaining support, special projects, or capital projects for nonprofit organizations that represent a broad field of interests, including, but not limited to arts and culture; education; the environment; family, youth, and elderly; health and human services; medical research; and community development.

For many years, Wallace & Turner has supported Second Harvest through financial contributions as well as been a sponsor and volunteer for numerous fundraising events. President Patrick Field donates significant time as the current Board Vice President and will serve as the incoming President for 2023.

Second Harvest Food Bank’s mission is to alleviate hunger in Clark, Champaign, and Logan Counties by sourcing and distributing nutritious food to people in need, building community partnerships, and mobilizing the public to support hunger relief.

Finding the Best Car Insurance Company for Your Needs – P.J. Miller Interviewed by MoneyGeek

Car insurance is important because it protects you in the instance of an accident or loss, and most people are not in a position to come out of pocket to pay for the replacement of a totaled car or another driver’s medical bills. In an interview with MoneyGeek, Vice President P.J. Miller discusses how drivers can balance balance risk management and affordability, how to educate yourself on the types of coverage available and how auto insurance premiums are set.

When asked about how consumers can better understand the types of car insurance policies, coverage and pricing, P.J. said: “Independent insurance agents can help drivers better understand their options. Because independent agents work with a variety of insurance companies, they can compare carriers and present the best cost and coverage options for the driver’s needs. They may also be able to obtain discounts that only certain carriers offer.”

Read the full MoneyGeek interview here.

Questions about finding the right auto insurance coverage for your needs? Contact us for a complimentary quote or to review your current policy.

Who Should Be Listed on My Car Insurance Policy?

Ways to Save on Home Insurance in Ohio

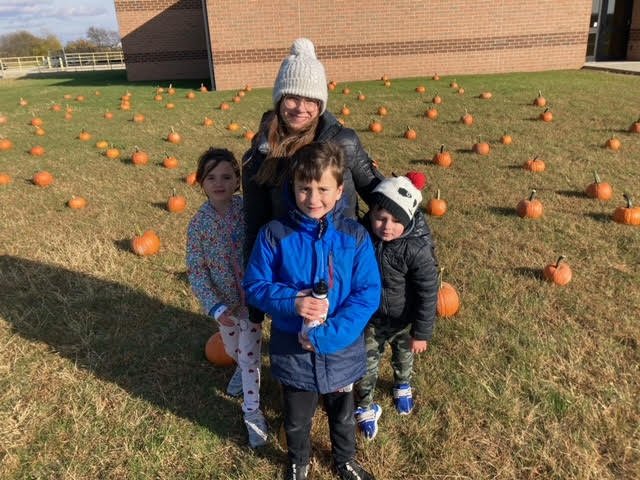

Wallace & Turner Supports Graham Preschool Pumpkin Day

Celebrating “Pumpkin Day” with Graham Preschool! Each student got to take home a pumpkin from Circle Farms courtesy of W&T 🎃

What is the Medicare Annual Enrollment Period?

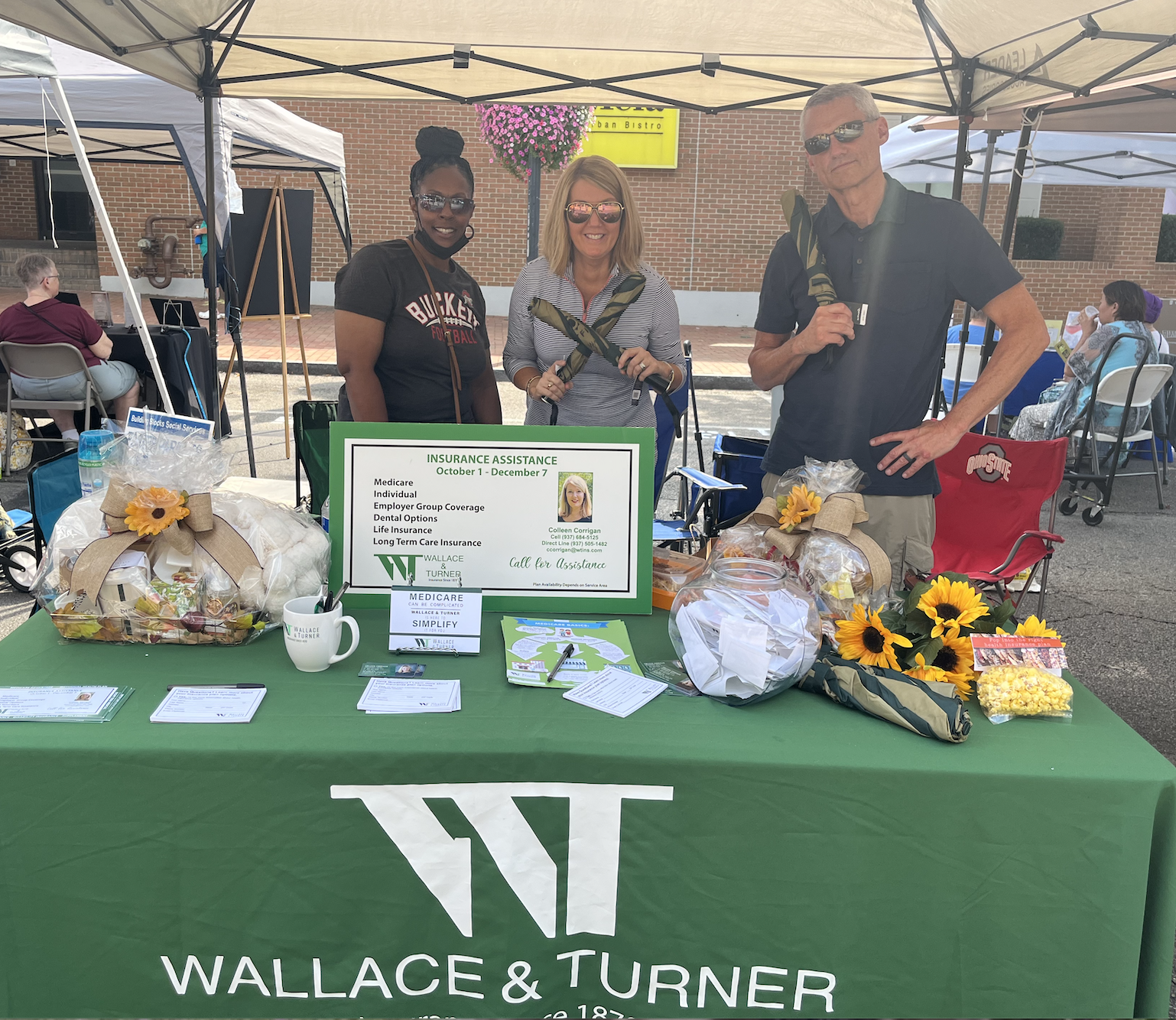

Wallace & Turner Participates in CultureFest 2022

The Wallace & Turner Life & Health team had a booth at CultureFest 2022 held on September 17th in downtown Springfield. The annual event is a celebration and collaborative effort between the City of Springfield Community Development Department with neighborhood and organizational partners committed to growing unity through diversity. CultureFest offered dance and music entertainment, children’s activities, a food court featuring international and American cuisine and merchandise and information vendors. CultureFest is supported through donations from individuals and organizations.

Congratulations to our gift basket giveaway winners, Rita Galbreath and Oakie Moore!

FAQs: Business Insurance for Small Business Owners in Ohio

New Score Table Heading to Cedarville University Athletics – Wallace & Turner Donates to Longtime Client

Wallace & Turner has gifted a new score table to be used in Cedarville University’s Stranahan Gymnasium. The gift will help the Yellow Jackets fulfill the need of enhancing the game day experience for student-athletes, staff, and fans at the Callan Athletic Center.

We are proud to be the University's insurance carrier for more than 20 years.

Learn more here.

Home Insurance vs. Home Warranties - What’s More Important?

What Types of Business Insurance Do I Need?

Wallace & Turner Sponsors Clark County Fair 2022

Wallace & Turner is once again serving as a sponsor of the Clark County Fair being held July 22-29, 2022. Fairgoers will be able to enjoy new and old attractions, food vendors, rides and live entertainment, as Clark County’s 4-H and FFA members compete with their animals. Gates open each day at 8 a.m. after the first day.

General admission is $6, which includes parking and admission into all concerts. Admission is free for children 5 and under.

Learn more about the events schedule:

Wallace & Turner Participates in United Senior Services New Patio Ribbon-Cutting Ceremony

Congratulations to United Senior Services on the opening of their new outdoor patio! Fun fact: the wrought iron fencing used is from the Crowell-Collier building, once the printing home of the world’s largest magazine publishing company, and where P.J. Miller's grandfather Peter Dennerlein served as VP & Plant Manager.

Be sure to stop by to enjoy their new amenity this summer!

Wallace & Turner Sponsors 2022 United Way Annual Golf Scramble

Wallace & Turner is once again sponsoring the 2022 United Way Annual Golf Scramble being held Friday, September 9, 2022 at Windy Knoll Golf Club. The Scramble includes a shotgun tournament starting at 11 am, followed by awards at 4 pm.

The event supports United Way of Clark, Champaign & Madison Counties which aims to nurture a safe, healthy, caring community that builds on the strengths of its citizens, its neighbors, its businesses and its human services delivery systems.

Register for or sponsor the tournament here.

A Guide to Motorcycle Insurance in Ohio

Wallace & Turner is Growing! Julie Medley Joins Personal Lines Team; Life & Health Department Brings on Loran Axtell & Tammy Hodge

Wallace & Turner is excited to announce the addition of several new team members: Julie Medley as Personal Lines Account Manager, Loran Axtell as Life & Health Account Manager and Tammy Hodge as Group Benefits Manager.

Additionally, Tia Keith, formerly in the Life & Health Department, has moved into the role of Commercial Lines Account Manager.

We are also pleased to welcome Spencer McCleery as an intern. Spencer is currently attending The Ohio State University and majoring in Actuarial Science.

View our full team directory here.