Producer Ben Galbreath ready for The Chamber of Greater Springfield, Ohio Golf Open day at Reid Park Golf Course - “Springfield’s Major”!

Wallace & Turner Supports Someday Morning's Album Release Show

Great turn out for Someday Morning’s album release show at Mother Stewart’s Brewing in Springfield. Proud to support this awesome local band!

Wallace & Turner Sponsors Springfield Rotary Food Truck Competition 2019

Wallace & Turner was proud to support the Springfield Rotary 2019 Food Truck Competition at Veteran’s Park Amphitheater featuring 35 different food trucks.

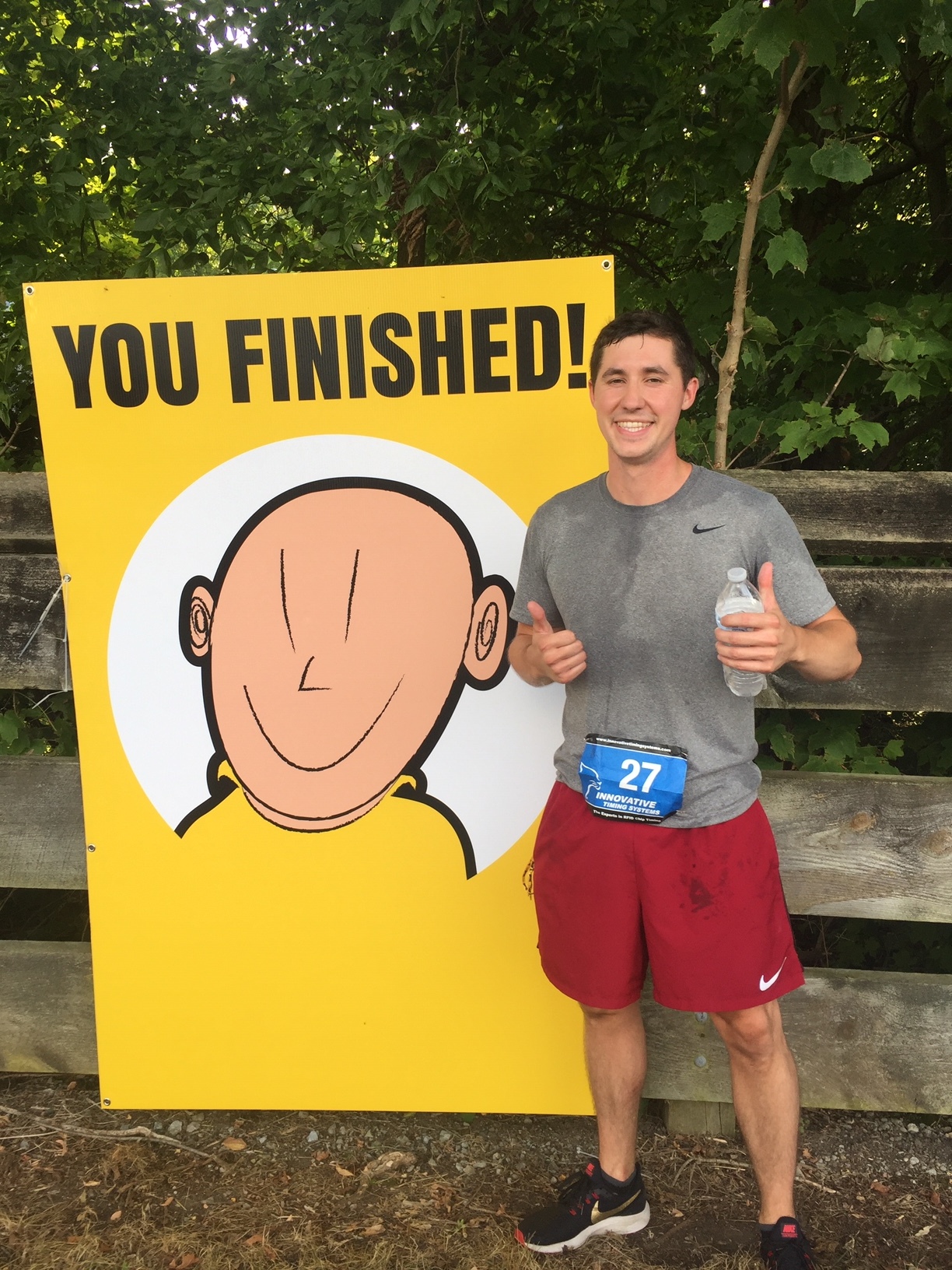

Happy Half Marathon 2019: Wallace & Turner Sponsors & Participates

A great morning for the Happy Half Marathon. Chris Johnston and Zach Vaughn both achieved their personal goals! Great race for a great cause!

Happy Half Marathon Candy Land Water Table Sponsor

Here’s a sneak peek of our Happy Half Marathon Candy Land water table theme 🍭 as well as two of our runners -- Chris and Zach both have personal goals and they, as well as Wallace and Turner, are thrilled to be able to participate in a great cause. Good luck to all the runners ! 🏃♀️🏃♂️

Professional Liability Insurance: What’s Covered (and Not)

Professional liability insurance provides coverage for claims resulting from negligent acts, errors or omissions and personal injury arising from the provision of professional services. Professional services include, but are not limited to, advertising agencies, auctioneers, technology consultants, employment agencies, contractors, architects, lawyers, doctors and accountants. For professions with a professional exposure, this line of coverage is as critical as general liability.

What’s covered and not covered

Professional liability is a separate coverage which can be purchased as an endorsement to a business owners policy or commercial insurance package. Although professional liability policies are not uniform, most commonly these policies provide coverage on a claims-made basis, which include two dates. First, the retroactive date is usually specified in the Declarations page. The error or omission of the potential claim must have taken place after the stated retroactive date and be prior to the expiration of the policy. Second, the claim must be initially reported during the covered policy period or the extended reporting period. These polices usually exclude exposures which are covered on other policy forms such as general liability. Losses based on fraud, dishonesty or criminal acts are not covered (the cost of defense for such claims may be paid). Other exclusions include bodily harm to any person, libel and slander, illegal discrimination and insolvency.

The most common specific types of professional insurance, include:

Malpractice insurance: To assist medical professionals accused of negligent behavior or mistakes.

Errors and omissions liability: Professionals that consult and or deal on knowledge and advice.

Directors’ and officers’ liability: Specifically dealing with any negligent behavior or errors committed by top ranking officials.

For profit and nonprofit entities.

How a professional liability policy can cover you

Example: An IT consultant has been contracted to back up their clients’ records and website. The backup is either not completed or the attempt fails, and all data is lost along with the website. The client depends on their website for customer traffic and all sales. It takes one month to redesign the website and the business has a substantial loss of revenue and key accounts. A professional liability policy would protect the IT consultant for their negligence and indemnify the client.

Example: A real estate agent fails to disclose a known problem or defect in a property, such as a problem with mold or radon. The home buyer learns of the problem after the sale is complete, and sues the agent for not disclosing the problem and for the additional costs involved in remediation.

In summary, general liability coverage protects a business from claims resulting from bodily injury or property damage suffered by a third party. Professional liability protects a business from economic damage claims resulting from professional mistakes.

Contact Wallace & Turner Insurance to learn more about a professional liability policy.

Client Spotlight: Plastic Lumber Store - Innovative Recycled Products

Wallace & Turner Insurance spoke with our insured David Cook, owner of Plastic Lumber Store in Springfield, Ohio to learn more about his innovative company, and the range of recycled products and services offered to the community.

When was Plastic Lumber Store established and what prompted opening the company?

Plastic Lumber Store was established in 2009 and our physical retail store opened in 2017. We wanted to offer something new and unique: long lasting, green building made from recycled materials.

Anything outside, made from wood, can be done from recycled Plastic Lumber and it will last generations.

What services/products do you offer?

Our main offerings include: recycled plastic lumber, plastic sheet and furniture; recycled rubber mulch, mats, pavers and landscaping products; LED lighting – interior and exterior; and solar solutions.

It looks like you can create a variety of customized products. What’s the most interesting/unique customization you’ve done?

Solar furniture, where you can utilize long lasting plastic furniture combined with the plug-in feature of solar power.

You have both a store front and online shop—will customers find the same products at each?

We can build and customize many projects so there’s really endless possibilities whether you shop online, stop in the store or give us a call. We’re happy to discuss options and make recommendations.

Anything else potential customers should know?

Recycled Plastic Mats: Durable, long lasting, and stylish for your outdoor living space.

Recycling uses less energy than making a product from scratch and reduces the amount of waste sent to landfills and incinerators. It also helps conserve natural resources such as timber, water and minerals, and prevents pollution by reducing the need to collect new raw materials. This allows our costs to be substantially lower than buying, maintaining and replacing similar wood items.

Contact:

David Cook

2400 North Limestone Street

Springfield OH 45503

937-561-8888

Website: https://www.plasticlumberstore.net

Hours: 9 am – 4 pm

Why Every Homeowner Needs Flood Insurance – Q&A with Partner P.J. Miller

P.J. Miller

How often does Wallace & Turner deal with flood insurance matters, and in what capacity?

In terms of frequency, it somewhat kicks up on a seasonal basis when there is heavier rainfall. We deal with matters somewhere between daily and weekly. Part of the reason for the almost daily occurrence is that when a sump pump backs up or goes out, water comes up through the floor drain and homeowners are wondering if this is covered by flood insurance or separate coverage.

Being an independent insurance agency, Wallace & Turner writes both personal and commercial flood coverage.

It's reported that only 7% of homeowners have flood insurance — why is it important to have a policy in place?

Flooding is the largest natural catastrophe, and largest single event natural catastrophe, that ever occurs. There are some places that would say earthquakes, but from the standpoint of frequency and severity, flooding is more predominant over every other natural catastrophe.

Part of the problem with the seven percent statistic, is that those seven percent are paying the premium for flood insurance coverage, and taking care of all of the floods that occur in the U.S. every year. In other words, people aren't buying flood coverage and when it occurs, the government (FEMA) has to step in and pay for those flooded areas in the form of monetary support, or offer low interest loans for people to get their homes put back together. It's clearly upside down with premiums versus people that haven't purchased coverage.

What are some of the main reasons every homeowner needs flood insurance?

The majority of claims, or when the federal government has to step in, come from areas that aren't typically seen as high hazard areas. Two-thirds of flood activity occurs in areas that are not high flood zones. Meaning, it's flooding in places that may have never flooded before.

What are some of the negative things that can happen if you don't have it?

The largest negative is that you wouldn't have any coverage for the damage of your house or its contents.

If you are in an area where you should have had flood coverage because it's a high flood risk zone, and if it is a repetitive loss situation, the government (FEMA and NFIP) may not cover assistance or loans due to the repetitive nature of the floods in your area.

One program that the federal government has in place is when the repetitive floods occur in a high risk zone, and for example, the person has been flooded three times, and each time the flood insurance or the government has to repair or rebuild the house, the government can come in and say "We've had enough. We're going to offer to buy your property and most likely raise it, and you'll need to move on." That program is at all-time high in its usage. Part of the problem, however, is that it takes quite a while for the government to get around to arranging to buy properties, and in the meantime, floods aren't stopping. Ohio is fifth in the nation on the list of the government trying to step in and buy homes. Additionally, areas like Texas, Louisiana and the Carolinas/coastal areas rank highest.

What else should homeowners and business owners be aware of in terms of flood insurance?

Flood premiums are most likely going to rise by 25% per year in the higher flood zone areas. This is already happening now. If you have a loan on your property, the banks/lenders are required to force you to have flood insurance if you're in higher rated flood zones (e.g. A, AE, V).

The government has kept everything fairly well structured and hasn't made a lot of changes to the flood program in terms of how coverage applies to floods. Therefore, there are quite a few companies (private insurance carriers) that are opening up flood insurance markets, and expanding coverages and some benefits that the federal government doesn't have. Similar to how UPS and FedEx operate versus USPS.

If you have questions about flood insurance for your home or business, contact Wallace & Turner’s insurance agents to learn more.

Q&A with Local “Rock and Soul” Band Someday Morning - WT Supports Album Release Show

Wallace & Turner Insurance is proud to support Someday Morning’s album release show on August 17, 2019 at Mother Stewart’s Brewing. We sat down with the band to learn more about the members, their music and what we can expect at the show. Read more below.

Someday Morning: a four-piece blue collar “rock and soul” band that hints at southern charm and honors the sad stories told in the key of blues.

Band:

Troy Brown (Vocals/Guitar),

Reed Jones (Lead Guitar/Mandolin/Banjo)

Jordan Powell (Bass/Piano)

Dann Burd (Drums)

How did the band form?

The band really came together by “chance meeting.” Troy (Singer) and Jordan (Bass) ran into each other at a party...somehow the conversation of music came up, and we shared stories and battle scars from previous music ventures. At the time, neither one of us were doing anything musically. In fact, neither of us had any real intentions to get back into it. One conversation led to another and we met up to play through some songs. Troy showed Jordan a few he had tucked away and it all just clicked.

Shortly after that, Troy invited our drummer Dann to come out and see what he thought. Troy had known Dann from a previous project that was signed and toured the country. Immediately there was a connection and we played as a three piece for a while, however, we knew we needed an additional guitarist to carry the load. Jordan had known and played with Reed our guitar player years ago and mentioned how special of a player he was. We knew he was busy with a bluegrass project, but invited him out just to see if he had any interest. Well, needless to say there was interest and a connection, and the line-up was complete. Pretty unique line-up as we all somewhat come from different influences, but all of us come together to serve the song—we are definitely a “song first” band. (See official press release below)

How did you decide on a name?

Someday Morning comes from the idea that we are all going to do something “someday”—"Someday I’m going to do this”…“Someday I’m going to do that”… “Someday I’m going to get back to playing music.” “Someday Morning” simply means the day has arrived and it has officially begun.

Can you give us a quick background on each band member; are you all local?

Everyone in the band is married and Troy, Jordan and Reed have kids. We are all pretty local with Dann (Drums) and Troy (Singer) from the Urbana area, Reed (Guitar) from West Liberty and Jordan (Bass) is our Springfield native. We are a mixed bag as far as occupations. Reed is a teacher, Jordan a local firefighter and Troy owns a pest control business that Dann also works at.

Where do you get inspiration for your songs?

Inspiration for our songs come from life. Nothing made up, all things we’ve lived. Good times, bad times—it’s all there packaged as stories...both ours and yours.

We hear there is a new album coming out – can you talk about what fans can expect and any other details?

You are going hear a pretty organic approach to the album. Most of the production is very simple and not over produced. A lot of modern music has tons of fancy production, but we kept things simple to let the song really show through. Minus a little organ, what you hear on record is what we do live.

Tell us what’s going on at the Mother Stewart’s Brewing show.

Mother Stewart’s Brewing will be our new album release event and our second time playing in Springfield. We have a fantastic acoustic artist Cory Breth opening the night around 7:30/7:45 pm and we will go on around 8:30/8:45 pm. Thanks to wonderful sponsors like Wallace & Turner Insurance, this is a FREE show and all ages! So just show up, but definitely get there early as we are expecting a large crowd.

Where can fans find out about other upcoming shows or buy/download your music?

You can find us at most social and music sites. Just look for “Someday Morning music” and we should come up!

Anything else fans should know?

While we have been lucky to play some big shows with national and regional acts like Candlebox, Muscadine Bloodline and Royal Bliss, nothing is like a hometown show, and we are grateful for the opportunity to share our music with our family and friends while also having tremendous support from the community.

Press Release:

All within the past 15 years, four local musicians separated only by about 10 square miles in rural Logan, Champaign and Clark counties, collectively spent countless hours studying music at a collegiate level, signing record deals, opening for multi-platinum artists, recording albums at legendary studios from Nashville, to London, New York to Los Angeles, toured nationally as well as internationally ranging from France to China, performed for audiences nearly eclipsing 100,000, had original compositions appear on numerous charts, song placements on television shows, appearances on tv shows, and yet somehow had never met...

That all changed roughly two years ago when friends of friends led to chance meetings, led to Thursday night collaborations, led to the formation of “Someday Morning”... a four piece blue collar “rock and soul” band that hints at southern charm and honors the sad stories told in the key of blues.

While members continue to pursue other projects, this is by no means a “side project”...this is as lead singer Troy Brown states, a “passion project.” For these gentlemen who have been there, done that, there is no time to waste on any “delusions of grandeur.” He goes on, “It’s simple, this band is not about fame and fortune, it’s about the love of music, and being fortunate enough to share that with a like-minded group. We simply exist and write by only a few simple rules—open communication, and only playing music that is real and honest.”

That formula seems to be working as people have taken notice. In just a few short year since the band has started playing out, they have sold out two back-to-back hometown shows in Urbana, doing one-night acoustic and one night fully plugged in. Additionally, Someday Morning has opened for national and regional acts Candlebox, Muscadine Bloodline and Royal Bliss, all while “taking a chance” on an out-of-state competition that lived and died on “popular vote.” They managed to make the finals and the top five in a contest that included over 100 acts and competitions that spanned nearly three months.

Choosing Insurance Coverage for Your Restaurant

Wallace & Turner Insurance Partner P.J. Miller shares insights on purchasing insurance for your franchise restaurant, and potential mistakes owners make.

How does choosing/buying insurance for a franchise restaurant differ from choosing/buying insurance for an independent restaurant?

Some franchisors will dictate coverage types and amounts, and some might even dictate the actual carrier. Complying with the franchise-approved/required coverage plan does make it easier to arrange coverage instead of in the case of the independent that has to arrange their own, specific coverage. An independent can select their carrier, coverage, etc. Some franchise organizations will require that the franchise location(s) be insured within a Master policy.

What kinds of misconceptions might people have about restaurant insurance?

That it is easily placed. Financials, experience, regularly required automatic extinguishing equipment inspections and cleaning (all by contract); the need for adequate Business Interruption coverage – the single most important coverage for the owner if they want to reopen after the fire or other calamity. Many carriers are willing to insure restaurants but only if they have that “best practices” model of operation.

Who actually deals with the insurance for a franchise restaurant? The franchisee or the franchisor?

Depends on the franchisor and the contract. Wallace & Turner has seen it both ways.

What types of coverage do franchise restaurants need?

All of the regular restaurant-standard coverages but don’t forget about “reputation coverage.” Case in point, Papa John’s. The franchisees have to be reeling from the fallout caused by the founder – and if you haven’t seen the commercials, they’re from the local franchise owners telling us not to forget them, and what goes on corporately has nothing to do with them…continue to buy their product from their local small business owner. And then there was Chipotle with food product issues.

Any questionable insurance practices to look out for?

I wouldn’t call it questionable but many times an insurance carrier will have a better appetite for the new account, only to decide after some claims in the particular industry (restaurants for example) that they’ll leave that market or territory.

What would you say is the biggest mistake someone can make when choosing insurance for a restaurant franchise?

Inadequate Business Interruption (Income) coverage. The success rate of start-up restaurants is relatively low, then combine that with a calamity that puts them out of business for any length of time, whether it is weather related or a “bad food” item or recall, and they’re forced to rely on the insurance to bring them back to life.

Wallace & Turner has experience insuring franchise and independent restaurants. If you have questions about insurance coverage, contact us to learn more about your options.

Wallace & Turner Presents Check to Summer Arts Festival Raffle Winner

Producers Ben Galbreath and Myles Trempe present raffle winner check.

We hope everyone enjoyed another wonderful Springfield Arts Council Summer Arts Festival - we know this lucky raffle winner did! Thanks to everyone who came out and supported!

Why Your Business May Need Commercial Auto Insurance Coverage

By Myles Trempe

Business owners often distort the lines between personal auto insurance and commercial auto insurance, but it’s important to understand that a standard personal auto insurance policy has limitations or exclusions relating to the business use of a personal auto. If a small business operates company cars, vans or trucks, there is a great likelihood they need commercial auto insurance.

Further, if a business is involved with any of the following functions (but not limited to), they most likely need commercial auto insurance:

• Transporting product or equipment including heavy machinery

• Hauling tools and equipment to job sites

• Regularly driving long distances to meet clients or visit job sites

• Delivering any goods for retail

• Trucking or freight transportation

• Transporting people (livery)

• Hiring your vehicle out to tow other vehicles

Protection Against Liability

Business owners need commercial auto insurance to protect against auto liability for bodily injury and property damage to a third party. In addition to liability, medical expenses for injuries sustained, physical damage of the owned or rented vehicle, and uninsured motorists’ coverage would apply to a business auto policy. Just like any insurance policy, the range of coverage can be broadened by purchasing options or endorsements. For example, a policy could be written to apply to one specifically described auto or to apply to the named insured’s liability exposures arising from any auto. Any auto could pertain to the vehicles owned by the business, hired or leased, and lastly all autos used for business including those not owned.

Protecting Your Business Financially

A business auto policy is critical for protecting the business financially—and is required by the law. Commercial auto insurance policies have coverage limits in terms of liability. Typical coverage limits available for a commercial auto policy are $500,000 and $1,000,000. Having higher limits for your commercial auto prevents a financially damaging event from putting your business at risk. A general liability policy for the business does not cover the costs of claims that arise from work-related auto accidents!

Types of Commercial Auto Coverage

Several types of coverage may be included in a commercial auto policy, others are options that can be purchased separately. Those options include: collision coverage for costs associated with an accident regardless of fault; comprehensive coverage for damages other than collision; non-owned auto coverage for when you or your employees drive rented or borrowed vehicles; substitute transportation when a scheduled vehicle is being repaired along with towing and labor costs.

Take for example the individual who owns a business on their homes premise—they make furniture. They only have a personal auto policy. The business owner is delivering a piece of furniture to a client and proceeds to run the red light and hit the other vehicle. The damages include: physical damage to the business truck, physical damage to the other vehicle, and medical payments for sustained injuries. The personal insurance carrier denies the claim on the basis that the owner was using his vehicle for business purposes. The resulting $100,000 in damages to a third party (not including damages to the business vehicle) will be the financial responsibility of the business.

Learn more about Commercial Auto Insurance

An insurance agent can determine the need for a small business to have commercial auto insurance. Contact Wallace & Turner Insurance to determine if a business auto policy is right for you.

Ensure You're Protected: National Insurance Awareness Day 2019

When was the last time you reviewed your insurance policy? Have you had any big life changes or any coming up? Insurance Awareness Day reminds you to take the time to talk with your insurance agent to ensure you're protected in the event of an accident or damage. Scroll down to learn more in our infographic.

P.J. Miller Featured in DotCom Magazine Leader Roundtable Interview Series

P.J. Miller

Partner P.J. Miller was interviewed by DotCom Magazine for their Leader Roundtable Interview Series, where leading CEOs and Founders take part in a discussion about leadership and entrepreneurship.

When asked about the key to Wallace & Turner’s success, P.J. commented, “We’re local, and second and third generation owners. We have a staff person answering the phone that promptly addresses customer needs, and we will talk to you in-person about your claim. We’re visible in the community and a leading donor to many causes within our surrounding area. Moreover, our team is committed to providing clients with the best insurance protection and outstanding claims service when they need it most, all at a fair price.”

P.J. also provided advice for entrepreneurs starting out with a new venture and overcoming businesses challenges, as well as participated in the magazine’s popular “speed round” Q&A.

Protect Your Home: Limited Water Damage Coverage

An additional endorsement that could bring you peace of mind is Limited Water Damage Coverage. These are losses caused by water or water-borne material that backs up through sewers or drains from off the insured premises; water that overflows or discharges from a sump pump or related equipment; or water that exerts pressure or seeps from below the surface of the ground through an insured structure. This coverage is not flood insurance; Wallace & Turner can answer your questions about this separate coverage. Contact us at (937) 324-8492 or lmiller@wtins.com.

Bring Your Dog to Work Day 2019

In honor of Bring Your Dog to Work Day, we’re sharing photos of our favorite four-legged employees!

Flood Solutions: Insurance Against the #1 Natural Disaster

Flooding is the largest natural catastrophe and largest single event natural catastrophe that ever occurs, and only 7% of homeowners have flood insurance! Floods are not covered in your homeowners policy, but anyone can get the coverage as a supplement to their homeowners.

Flood insurance coverage to complement your homeowner policy.

We work with Cincinnati Insurance Company to offer Preferred Primary Flood or Excess Flood Endorsements as alternatives to insurance available from the National Flood Insurance Program.

Learn more about types of flood insurance, costs andwhy it’s important to have this coverage. Read How Much is Flood Insurance in Ohio?

Contact Wallace & Turner at (937) 324-8492 or info@wtins.com to discuss your options for flood coverage.

Insurance.com Interviews P.J. Miller on Factors That Impact Auto Insurance Rates

P.J. Miller

In an interview with Insurance.com, independent insurance agent and partner P.J. Miller noted that auto insurance rates vary by state for many reasons.

"Typically, there are different legal mandates or requirements that are more liberal to the injured party, making it easier to receive a greater settlement [thereby raising costs for the insurance company]," Miller says. "Lower labor rates, lower parts prices for vehicles, lower sales tax rates, fewer vehicles on the road, and mandatory auto insurance are a few of the factors that tend to keep rates down."

One factor that might surprise drivers is their credit score. Nearly every state allows insurers to base their rates at least partially on a person’s credit history.

"Most carriers use credit as a portion of the rate-setting process, where permitted by law. While it is supposed to be a portion of the rate calculation, most believe it plays a significant role in determining price," Miller said. "There are countless other factors that enter into the behind-the-scenes formulation that make it almost impossible to know exactly why you pay, or are quoted, the final rate."

Sticking to the state minimum will limit your costs, but it will also increase your risk. Miller commented that states typically have an incredibly low minimum mandatory limit. “Keep in mind that $25,000 doesn’t go far in crashes.”

When you shop for car insurance, first determine what level of coverage suits your needs.

Depending on the age of your vehicle, you might not need comprehensive and collision coverage. Miller also advised the following:

Combine your coverage: Bundle auto coverage with your home or renters’ insurance policy: Showing your loyalty to one insurer could help you land a discount, especially if you have multiple policies. Renew your plan early and you could get a discount, as well.

Be a good driver: "Speeding tickets can dramatically impact your rates," Miller said. Being a safe driver can lower your car insurance by 5% typically. Driving fewer miles a year will also reduce your rate.

Read the full article at Insurance.com.

If you have questions regarding auto insurance, please contact Wallace & Turner at (937) 324-8492 or via our contact form.

Wallace & Turner Once Again Sponsors Happy Half Marathon for 2019

The first official Happy Half Marathon was held in 2012, and the race brings together 200+ runners to support a cause and gives participants a chance to achieve their fitness goals. Wallace & Turner will again support the event as a Water Table Sponsor.

The idea for the race comes from family members running the 13.1 mile course from Springfield to Yellow Springs to train for a full-marathon in which they would be raising money to help cover the cost of cancer treatment for Mike Maloney, father of Co-Director Alex Maloney.

In 2018, the marathon saw record numbers with 256 runners, more than 170 volunteers, and 13 community sponsors. Most importantly, the Happy Half Marathon and the community sponsors donated $11,000 to the Springfield Regional Cancer Center.

Wallace & Turner Partners with Nationwide Insurance to Write Personal & Commercial Coverage

Wallace & Turner is now working alongside nationally-renowned Nationwide Insurance to write a full range of personal and commercial insurance policies. Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the United States.

“For our clients, this translates into another option for dependable insurance coverage that suits their needs and budget,” commented Wallace & Turner partner P.J. Miller. “Nationwide offers unique financial incentives and a broad scope of coverages.”

Grown from a small mutual auto insurance company, owned by policyholders who spent their days farming in Ohio, Nationwide’s coverage now extends to auto, home, life, small business and other personal and commercial insurance.

View Wallace & Turner’s complete list of insurance partners here and contact us to learn more about coverage options.

About Wallace & Turner, Inc.

Wallace & Turner has operated locally in Springfield, Ohio since 1870 and provides personal insurance, commercial insurance and life & health coverage. It is a member agency of Associated Risk Managers International, Keystone Insurers Group, Trusted Choice and Ohio Insurance Agents Association, as well as a long-standing member of the Independent Insurance Agents Association, both in Ohio and nationally.

About Nationwide

Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the U.S. and is rated A+ by both A.M. Best and Standard & Poor’s. The company provides a full range of insurance and financial services, including auto, commercial, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; banking and mortgages; excess & surplus, specialty and surety; pet, motorcycle and boat insurance. For more information, visit www.nationwide.com